YNAB offers its members online live workshops to master the art of budgeting. The app gives you real-time access to what you and your partner are spending from any device, anytime.

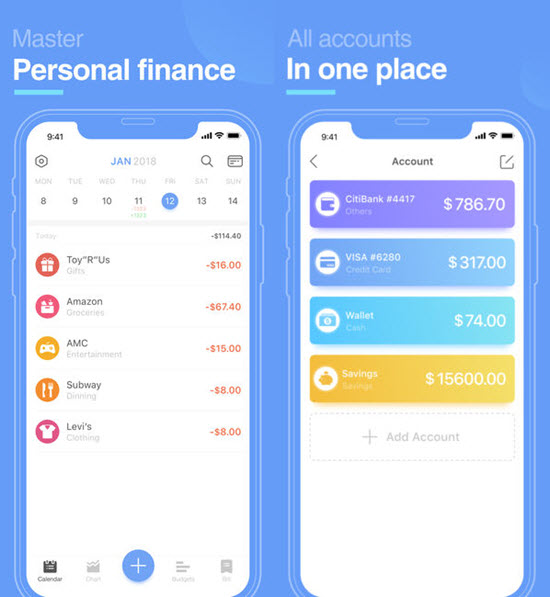

YNAB (You Need A Budget) is great for people who share their spending with a partner. It’s one of the best budget tracking apps out there. PocketGuard automatically pulls out transactions from linked accounts so you can see the categories, like “Travel” or “Utility Bills.” You can also set spending limits that trigger notifications when you’re about to cross the line so you can think twice. Users connect their checking, credit, and savings accounts, and the app crunches the numbers to show what you’re spending. PocketGuard boils down your budget to the bottom line: how much you have to spend. It’s a way to invest without even thinking twice, so you can start building up a nest egg. So when you spend $4.72 on that grande latte, Acorn rounds it up to $5, then sends the change to an investment portfolio for you.

The app automatically keeps the change every time you swipe a linked credit card. By linking your bank, loan and credit accounts, the app analyzes the information in those accounts and lets you break out spending into categories like “Entertainment” and “Food & Dining.” That way, you can see how much you can save by cutting back in each category.Īcorns gives people a way to save money without even thinking about it.

Mint suggests budgets for you based on your spending. It automatically updates and categorizes transactions so you get a picture of your spending in real time. Mint is a great app for monthly budgeting. We reviewed the best budget apps on the market and compiled a handy list to get you started. The 8 Best Budget Apps for Saving Moneyīudgeting doesn’t have to be overwhelming! It’s just a matter of taking that first step. These apps make tracking your everyday spending a snap, so you can see where you can make little changes that’ll add up quickly. Thanks to the internet, you can take advantage of free budgeting apps to make it easier to manage your money. If you’re looking for ways to get your finances under control, creating a budget is one of the best ways to start.

0 kommentar(er)

0 kommentar(er)